Businesses send a one-time password (OTP) and SMS text to the user’s phone as part of the SMS OTP verification process. The company sends OTP to the user, who then enters it on the device used for authentication. There is a timeline for using the OTP. OTPs sent via texts protect against phishing and malicious attacks. It is advisable to combine SMS OTP with other techniques, including passwords.

What Is SMS OTP Verification?

Websites, applications, banks, and social networks may double-check a user’s identity through SMS verification. Companies will send an SMS verification number to your mobile number once you enter your username and password. This procedure is SMS verification; enter that code to complete your login.

What Is A One Time Password?

A one time password (OTP) is a secure method for providing one-time access to an application or performing a single transaction. An OTP is most effective and legitimate for a single transaction, unlike user-generated passwords. OTP expires in a few minutes.

The OTP service enables your company to give customers one-time passwords via email, text, and voice message. Your company may automatically generate an OTP in response to a customer’s login or transaction request. The randomly generated string of alphanumeric characters makes these OTPs challenging to break and hack.

Businesses may use the OTP SMS API to secure transactions on their website, mobile app, and third-party apps. You may monitor OTP delivery status using automated analytics reports – successful, unsuccessful, and reattempted. The OTP services help your business protect business transactions.

How Do SMS OTP Verification Numbers Work?

- During the signup process, give a business your phone number.

- After entering your login information, you receive an SMS code.

- Enter the code to login to the app or website.

Why Send An SMS OTP Verification?

One-time passwords and temporary codes are two widely used methods of user identity:

1. Minimize Friction

You may use SMS OTP verification to provide password-free logins, removing the need for users to keep track of their passwords. The system will automatically transmit a code to enable access after verifying registration.

2. User Data Verification

You may also use them on lead qualifying flows to assess the correctness and usefulness of your database’s contact information or confirm its legitimacy.

3. Preventing Fraud

You can prevent the same individual from taking advantage of a discount using multiple email addresses, and you can use temporary codes in coupon campaigns to link emails to phone numbers and prevent fraud.

4. Enhance Security

Multi-factor authentication procedures require the user for credentials such as their email address and password before sending them a temporary code to complete second identity verification.

How To Pick The SMS Verification Number?

1. Ensure Truecaller Verification

Truecaller has 100 million spam-detection users in India. Ensure Truecaller can verify your SMS verification number.

2. Check Delivery Costs

Your customers must always be able to authenticate their identity or transact securely. Pick a supplier with excellent uptime, scalability, and delivery.

3. Check Compliance

Choose an SMS verification number that complies with TRAI guidelines and DLT template scrubbing to ensure OTP delivery.

4. Ensure Real Time Visibility

After sending SMS OTPs, monitor their performance. Analyze delivery, open, and click rates for this.

This information may help improve results. If your reports show that many consumers request an OTP repeatedly, consider raising the expiration period on the initial OTP message delivered to them.

5. Choose A Brand-Related SMS Verification Number

Customers demand to know promptly who sent messages. Sender ID replaces the sender’s 10-digit number. Pick a service that can provide you a six-character sender ID.

Why Is SMS The Most Effective OTP Verification Method?

SMS is a simple authentication method. Almost everyone has a mobile phone. Using and receiving SMS is simple and cost-free. It also provides several advantages for businesses.

1. High Delivery Rates

You may rely on receiving the codes while using SMS OTP verification.

2. Low Latency

SMS OTP verification is quick. Get delivered in an average of 3 to 8 seconds.

3. High Reading Rates

People read SMS more often than email and app notifications.

4. Security

SMS OTPs are temporary, unlike passwords, protecting users from future abuse since the company sends them to the user’s registered mobile number.

What Are The Uses Of SMS OTP Verification For Business?

Financial services widely use SMS verification since the RBI mandated two-factor authentication (2FA) for all online card transactions. However, companies use OTPs and SMS verification in different ways. Below are some ways

1. Authorization

Access security is essential beyond financial transactions, such as entering into secure websites/mobile applications from an unrecognized device, a different location, or an IP address. As part of their 2FA requirement, many online banking services need OTPs since SMS verification is a quick and secure way to confirm the user.

2. No-Password Login

It’s difficult for customers to remember passwords for every website or service. SMS verification permits login without a password. Login with OTP is popular with customers who don’t want a password.

3. Password Reset

Password is important to login into a platform, and it is crucial to prevent unauthorized access and ensure that only the account owner may change the password. SMS verifies user identity for business. Users can first get an OTP to validate themselves when they request a password reset.

4. New Signups

It is typical for companies to get fake signups or incorrect mobile numbers via their websites. It wastes time and resources by producing a big database of unreachable customers and businesses using OTPs during registration. Confirming the user’s mobile number can assure its accuracy and use.

5. Activation Of An Account

Account reactivation is another use case for OTPs to prevent fraudulent access and password reset. Criminals sometimes attempt to reactivate inactive accounts for fraudulent purposes after a long period of inactivity. Companies also send marketing messages to inactive users, asking them to reactivate. However, authentication is crucial, and OTP verification is a convenient method.

6. Delivery And Order Confirmation

Some deliveries, such as return pickups, credit cards, and high-value orders, require extra security at the customer’s doorstep. OTPs are an excellent method to confirm the delivery of the order or pickup by the proper person in real-time.

7. Verification Of Transactions

The best way for all kinds of transactions, including online purchases, recurring payments, credit card bills, and others, is SMS verification. Businesses verify the cardholder’s identity by sending them an SMS OTP.

Also Read: How IVR Services Help Businesses to Grow?

How Can OTP Service Protect Your Business Transactions?

1. Prevent Password-Based Attack

User-generated passwords are simple to guess. It is simpler for cyber criminals to perform security attacks such as password sniffing, brute force attack, and dictionary attack. The OTP services restrict the ability of thieves to guess passwords using mathematical techniques.

The algorithm that creates OTPs combines numeric and alphanumeric characters randomly. Therefore, it becomes simpler for your business to protect against various password-based security attacks successfully.

2. A Few Minutes Of Password Validity

Using the same password for many transactions harms corporate and consumer data security. You can use one-time passwords for only one transaction.

It expires in a short time. Time synchronization expires passwords after a short time. The consumer must request a fresh OTP once the password has expired to finish or repeat the transaction.

3. Securely Send Important Information

You can send OTP to mobile number by text message, email, or voice. However, it sends the code to an email address and a mobile number to increase the registration process’s security.

The company sends these codes in less than 10 seconds using rapid and secure SMS APIs. You can use those APIs with any application to activate OTPs at crucial checkpoints.

4. Verify Business Transactions

Dynamic passwords have replaced static ones due to OTP services. Businesses use this service to protect eCommerce purchases, digital payments, account reactivation, account cancellation, and password resets. Enterprises use OTPs’ hard-to-crack feature to protect digital transactions and client data.

5. Implement Two-Factor Authentication

Two-factor authentications secure different business transactions by replacing user-generated passwords with one-time passwords. By sending a one-time secret key (OTP) to a customer’s registered mobile number, the security method enables your business to cross-verify its identity.

It needs the agent to verify their identity by entering the OTP after signing in with the existing username and password. In addition to securing business transactions, two-factor authentication provides additional protection for the website, mobile applications, and enterprise software solutions.

6. Overcome Static Password And PIN Limitations

Most customers make financial transactions and transfer sensitive data using static passwords PINs. They frequently fail to make passwords difficult to crack. Using the same password for several transactions or login sessions increases the vulnerability of financial transactions and sensitive data to targeted security attacks.

Numerous cybersecurity experts warn clients not to use passwords that are dangerously simple to guess. OTPs protect client data and digital transactions by overcoming the limitations of static passwords and PINs. Many cybersecurity experts recommend replacing static passwords/PINs with dynamic, transaction-specific passwords, and OTP service enables two-factor authentication.

7. Choose From Many Otp Generation Approaches

OTP providers create passwords using complex algorithms. The method makes the password tough to guess, using alphanumeric and numeric patterns. Some companies even let businesses choose from a variety of OTP generation methods.

You may use a time-synchronization-based strategy to have the dynamic password expire after a specific time. Similarly, you may create the password using various algorithms depending on the previous OTPs delivered to the consumer. Additionally, the complex algorithms enable you to activate OTPs depending on certain conditions.

A company may also use the OTP service to provide clients a one-time password in 10 seconds using voice and SMS platforms. They may also track OTP delivery status and create unique OTP messages without expending extra time or effort. A reliable OTP service protects your company’s reputation and finances by preventing password-based security attacks.

What Benefits Does SMS OTP Verification Offer?

1. Easy To Use

Complex authentications will frustrate users. A quick and safe solution, in this case, is SMS authentication.

2. Low Cost

A business with a broad customer base benefits significantly from the small costs of sending SMS to customers.

3. An Added Layer Of Protection

Nowadays, two-factor authentication protects user accounts. SMS authentication adds an added layer of protection and is simple. It is certainly preferable to have no additional security check.

How To Pick An SMS OTP Verification Service

1. Security

The users’ messages must be secure. If not, attackers may intercept unprotected communications and access users’ accounts. Choose an SMS OTP verification service that provides high-standard securities.

2. Excellent Support

You need a service provider that can give rapid assistance if anything goes wrong.

3. Flexible APIs

If you are building an OTP authentication system using APIs, ensure that your supplier’s APIs are flexible and easy to integrate with your backend systems.

4. Scalability

Always choose an SMS verification service with quick scaling up and scaling down capabilities to meet your business needs.

5. Rapid Delivery

One-time passcodes often include a time limit, so users must input the code before it expires. You need a large-scale verification solution that can handle a large scale without losing performance if you send clients thousands of SMS 2-factor authentication messages.

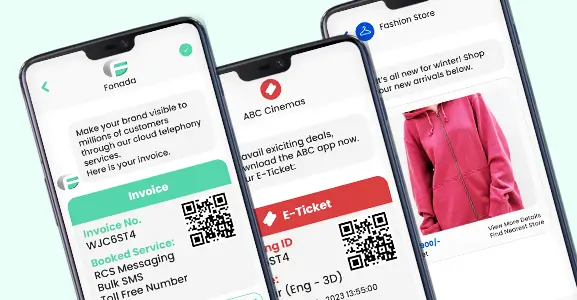

Fonada Offers A Robust OTP Verification Service

1. Excellent Pricing

Fonada provides the most competitive pricing on the market.

2. Reports In Real-Time

Measurements like delivery, open, and click rates can help you understand the effectiveness of your OTP SMS campaigns.

3. Simple To Use And Implement

You may develop an SMS campaign on the platform within five minutes due to its easy and simple interface.

4. Enhanced Security Protocols

By using strong procedures, our site is completely secure. Your client data is therefore entirely secure with Fonada.

5. Industry-Standard Delivery And Engagement Rates

Your business messages are always delivered quickly using Fonada’s sophisticated SMS routes, enabling real-time communication.

Conclusion

An additional security measure is an SMS OTP. A secure authorization method sends a numerical code to a mobile phone number. Signing in online validates the user’s identity. One-time passwords protect against identity theft by preventing a username/password pair from using it twice. It is feasible to save you identification theft and email address hacking by using SMS OTP verification. Call Fonada to get an OTP verification service for your business.

Dec 11, 2024

Top Contact Center Optimization Tools For 2024

“A thriving business knows how to fetch maximum output from limited resources by optimizing ca... Read More

Nov 13, 2024

What Is Brand Communication? CPaaS Role Explained

Did you ever wonder why some advertisements grab your attention instantly, while others do not? The... Read More

Nov 01, 2024

What Is Automated Messaging And How Does It Work?

Automated messaging or text automation empowers businesses and marketing professionals to connect wi... Read MoreLatest Updates

From Fonada

Industry Insights, Trends, Innovations, Updates, and Case Studies from Industry Experts

View

Customer

Reviews

Discover why our customers love us - read their authentic and heartfelt reviews!

View

Case

Studies

Explore real-life scenarios, offering analysis, and solutions to practical challenges

View

Convert Leads Into Sales With Fonada

Trusted CPaaS Solution Provider